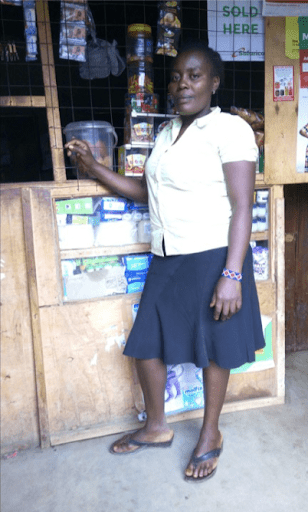

“My name is Josephine. I’m married and blessed with two children.”

Josephine and her family live in Kimana, a community in the Loitokitok Sub-County of southern Kenya on the border with Tanzania. She is a member of our community banking initiative, the Village Investors Program (VIP).

“Before I joined the VIP, my life was different compared to now. Together with my husband, we depended on casual labor which was not guaranteed on a daily basis. On a good day, we would make Ksh 500/= ($4.30).”

Vulnerable employment is a prominent issue in Kenya, where over 51% of the country’s population are unlikely to benefit from formal work arrangements, adequate earnings or decent working conditions (The UNDP, 2019).

Living with an unstable income can be hugely challenging for a family, making households extremely vulnerable and often unable to cope during unexpected events and shocks. Unsure where their next set of earnings may come from, families are forced to pursue activities that secure an income in the short-term, often at the expense of developing a sustainable livelihood that will create long-term security.

Through the VIP, we empower parents or guardians of vulnerable children to work together in a community banking group and provide training in business and financial skills. Members of a VIP group are able to access pools of money to launch and grow their own businesses, and make investments in their futures.

“In 2019, I heard about the VIP in our area. When I joined my group, I started by saving Ksh 200/= ($1.70) per week. After a few months of saving, I took out a loan of Ksh 3,000/= ($26) and paid school fees for my children. I managed to repay the loan on time.

“Since loans in our VIP group were readily available, I started planning how to change my life financially. It was then that I took out a loan of Ksh 9,000/= ($77) and started a kiosk business. With time, the business was booming and I would make a daily profit of Ksh150/= ($1.30) to Ksh 200/= ($1.70) and this was a blessing to my family.”

Having a consistent and dependable income enables a family like Josephine’s to look ahead and plan for their future with confidence.

“Along with making savings, we organized an Income Generating Activity (IGA) which my family relied on for a regular food supply. As a group, we also supported orphans and other vulnerable children with scholastic materials, which is a blessing to us too.”

In addition to members’ individual businesses, every VIP group establishes a joint IGA. Often, they will purchase large quantities of popular goods at wholesale prices and then sell them within the group for a profit, which builds the loan capital of the group. Josephine’s group sells sugar, maize flour and cooking oil to boost their income.

At the end of a savings cycle, which is usually once every year, group members “share-out” the savings and interest that has built up over time. From our data, we know that on average, each VIP member receives $90 at the end of each group share-out, before then being able to re-invest their money back into a new savings cycle.

“During our first group share out, I received a total share of Ksh 14,600/= ($126). I kept Ksh 10,000/= ($86) and I gave the rest to my husband.” This money supported Josephine’s husband to launch his own bakery business, providing another source of income for the family.

“With the money I gained, I was able to expand my kiosk business into a retail shop. I started my shop with a capital of Ksh17,000/= ($146), of which Ksh10,000/= ($86) was from VIP savings and Ksh7,000/= ($60) from my previous kiosk business. After the COVID-19 pandemic hit, my business almost went to its knees but I am thankful things are now going well.”

The COVID-19 pandemic was particularly disruptive for female entrepreneurs, with 43% of women-owned businesses closing across Sub-Saharan Africa, compared to 34% of those owned by men (The World Bank, 2020). One of the main aims of the VIP is to economically empower women, as they are not only likely to be the primary caregiver to children, but also face greater difficulties in accessing opportunities to earn an income.

This is one of the reasons why we are delighted that out of the VIP groups currently in training, 81% of the 11,800 members are women!

“I never imagined that one day I would run my own business and I am so grateful to the VIP for teaching me new skills and knowledge. I am happy and my family has been really transformed. Now, my business is worth around Ksh30,000/= ($258) and I am still aiming higher. My dream is to own a mini-store where I will meet my customer’s expectations.”

Since taking out the loan of Ksh 9,000/= ($77) to kickstart her kiosk, to her shop now being worth Ksh30,000/= ($258), Josephine has been able to grow her business by over 230%!

This growth has supported her to develop a sustainable and dependable income. Now, she can accommodate for her children’s needs and ensure that they have access to healthy and nutritious food.

“With the VIP, the future is bright,” Josephine says.